How to Calculate Closing Inventory

The closing stock can be in various forms such as raw materials in-process goods WIP or finished goods. The raw materials are generally recorded with a debit treatment to the asset account for the inventory and credit treatment in the liabilities account for the account payable.

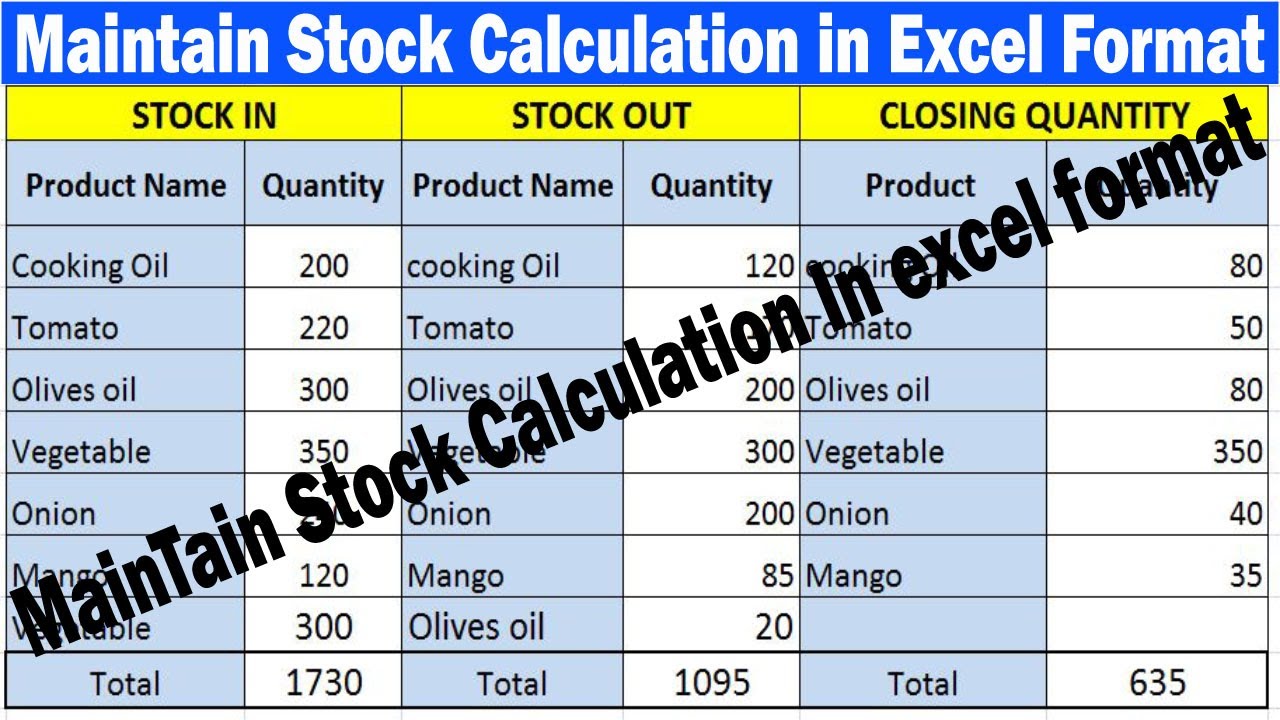

How To Maintain Stock In Stock Out And Closing Stock In Excel Format By Learning Centers Excel Tutorials Excel

The inventory is considered to be a hazardous item in the balance sheet.

. It would directly improve the ratio which is valid at. Why Does Inventory Get Reported on Some Income Statements. This is crucial as the excess or shortage of inventory affects the production and profitability of a business.

With this framework in mind you can calculate your total food budget based on your take-home income. To avoid the situation of non-availability of ratios one uses the debtors and receivable closing balances but this practice would have serious questions on the correctness of the ratio. The way and methods used to calculate closing stock differs from each other and it has a direct impact on the profitability of.

We understand Closing inventory as ending inventory from the traditional or classical academic point of view. To find the information you need to calculate working capital you. Inventory directly affects the businesss financial statement.

Closing Stock Formula Ending Opening Stock Purchases Cost of Goods Sold. Inventory is an asset and its ending balance is reported in the current asset section of a companys balance sheet. How to Calculate Raw Material Inventory.

Some current asset examples are cash accounts receivable investments that can be liquidated and inventory. Average inventory is calculated using the below formula. So shell need a total of 385 for food each month.

Formula to calculate average inventory. Inventory fluctuations can wreak havoc on more than just your stockroom. The computation of raw materials varies on the basis of their nature and type such as direct materials and indirect materials.

Closing costs are fees that lenders charge a borrower or home buyer to acquire a mortgage loan. For example suppose you purchased 100 shares of stock for 1 each for a total value of 100. Inventory in the Balance Sheet.

Add the beginning and ending inventory and divide by two to get the average. Lets calculate COGS using the formula above. Businesses count inventory mainly in two ways.

As a result the inventory asset on the balance sheet is recorded at the most recent cost. A value measurement for. Top 4 Methods to Calculate Closing Stock.

As the name suggests it is calculated by arriving an average of stock at the beginning and end of the period. Opening stock Closing stock 2. When recorded inventory levels are lower than actual inventory counts understated the cost of goods sold rises artificially.

The closing price represents the most up-to-date valuation of a security until trading. Opening inventory is the value of inventory that is carried forward from the previous accounting period and is used to compute the average inventory. Inventory is not an income statement account.

Reporting of Inventory on Financial Statements. To determine the average inventory look on the firms balance sheet for the beginning and ending inventory for the period. The cost of inventory is an item in the cost of goods sold in an income statement.

3 Methods to Calculate Inventory Closing. The formula is Sale Price - Cost Basis Capital Gain. In general similar companies in similar industries dont always account for both current assets and liabilities the same internally or on their financial reports.

Read more the first item purchased is the first item sold which means that the cost of purchase of the first item is the cost of the first item sold which results in the closing Inventory reported by the business on its Balance sheet showing the. Average inventory is an estimated amount of inventory that a business has on hand over a longer period. COGS helps you evaluate the cost and profits but also helps plan out purchases for the next year.

Suppose the cost of goods sold equals 3 million and the average inventory equals 600000. Divide 600000 by 3 million and multiply by 52. Closing inventory also known as ending inventory is the value of the stock at the end of the accounting period.

Suppose the debtors decrease at the end of the financial year due to some seasonal business effect. For example Rita makes 3500 per month after taxes. Conversely when actual inventory levels are lower than those recorded overstated the inverse occurs and COGS is artificially lowered.

She would budget six percent for groceries 210 and five percent for restaurants 175. It also helps to determine cost of goods sold. Inventory valuation is done at the end of every financial year to calculate the cost of goods sold and the cost of the unsold inventory.

Profit and loss account and the balance sheet. Beginning Inventory Purchase - Ending Inventory. The risk even increases if the business operates in the manufacturing sector.

Under this approach system will identify the material movements inout within the period based on assigned Movement Types Transaction Code OMW4 and calculate the FIFO price as Rs. Determine the Gross. The cost of direct materials is used to calculate the turnover ratios and inventory cost used during a trading period.

In manufacturing it includes raw materials semi-finished and finished goods. Having this information lets you calculate the trust cost of goods sold in the calendar year. COGS 20000 8000 - 6000 COGS 22000.

Nonetheless it refers to the amount of inventory in stock at the end of the commercial year. The reason is that business operating in manufacturing segment is expected to have a greater quantity of raw material work in process and the finished goods. However the change in inventory is a component in the calculation of the Cost of Goods Sold which is.

The closing price is the final price at which a security is traded on a given trading day. In simple words its the inventory which is still in your business waiting to be sold for a given period. The difference between the buying price and the selling price is your capital gain or loss.

The FIFO run can then compare the FIFO value with the Book Value and revalue the inventory to the FIFO Price and post the revaluation entry. They typically total 2 to 7 of a homes purchase price. Calculate the difference.

The method which company decides to use for pricing its closing stock will have a huge impact on its balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders equity liabilities and.

Ending Inventory Accounting Double Entry Bookkeeping Inventory Accounting Small Business Tax Accounting

How To Calculate Ending Inventory Without Cost Of Goods Sold

Cash Register Till Balance Shift Sheet In Out Template Google Search Counting Worksheets Worksheet Template Balance Sheet Template

Job Costing Accounting System Double Entry Bookkeeping Cost Accounting Accounting Bookkeeping Business

No comments for "How to Calculate Closing Inventory"

Post a Comment